If you’re in need of financial assistance for your housing, education, or business needs in the Philippines, the Pag-IBIG (Pagtutulungan sa Kinabukasan: Ikaw, Bangko, Industriya at Gobyerno) Fund offers various loan programs to help you achieve your goals. Applying for a Pag-IBIG loan may seem overwhelming at first, but with a step-by-step guide, you’ll be able to navigate the process with ease and confidence.

How to loan in a Pag-IBIG: A Step-by-Step Guide

Applying for a Pag-IBIG loan can be a daunting process, but with this step-by-step guide, you’ll be able to navigate through it smoothly and efficiently.

Step 1: Determine your eligibility

Before you apply for a Pag-IBIG loan, it’s important to check if you meet the eligibility requirements. These include having at least 24 monthly contributions, being an active member, and having no existing Pag-IBIG housing loan.

Step 2: Prepare the necessary documents

Once you’ve confirmed your eligibility, gather all the required documents. This usually includes valid IDs, proof of income, employment documents, and other supporting papers. Make sure to have multiple copies and keep them organized for easy processing.

Step 3: Fill out the loan application form

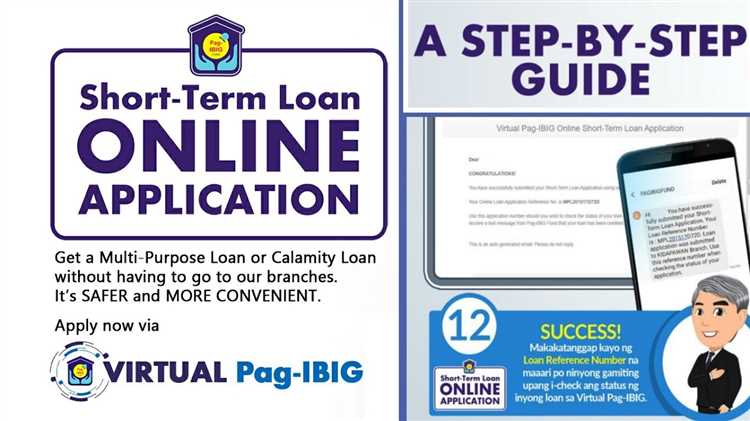

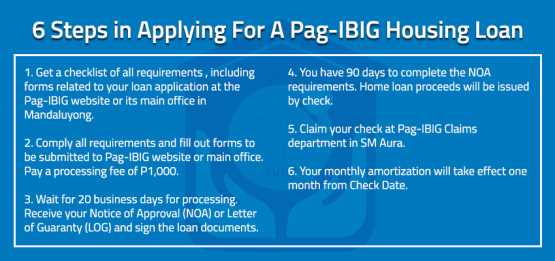

Obtain a loan application form, either online or from the nearest Pag-IBIG branch. Fill it out completely and accurately. Make sure to provide all the required information and double-check for any errors.

Step 4: Submit the loan application form and documents

Bring your filled-out loan application form and necessary documents to the nearest Pag-IBIG branch. Submit them to the designated officer or at the loan processing area. They will assess your documents and provide you with instructions for the next steps.

Step 5: Attend loan counseling and approval

Once your application is received, you will be scheduled for a loan counseling session. During this session, a Pag-IBIG representative will explain the loan terms, interest rates, and repayment options. They will also inform you if your loan application has been approved.

Step 6: Loan release

If your loan application is approved, you will be notified about the loan release date. Make sure to be present on that day and bring the necessary documents for the loan release process. The loan amount will be released to you or directly to the seller, depending on the type of loan you applied for.

Step 7: Begin loan repayment

After the loan release, it’s essential to start repaying your loan on time. Pag-IBIG offers various payment options, such as salary deduction, post-dated checks, or online payment facilities. Choose the method that is most convenient for you and adhere to the repayment schedule.

Follow these steps carefully, and you’ll be on your way to securing a Pag-IBIG loan smoothly and efficiently. Remember to stay organized, be prepared, and comply with the necessary requirements to increase your chances of a successful loan application.

Determine Your Eligibility

Before you start applying for a Pag-IBIG loan, it’s important to determine if you are eligible. The eligibility requirements may vary depending on the type of loan you are applying for, but for most Pag-IBIG loans, the following criteria must be met:

| Eligibility Requirement | Description |

| Membership | You must be an active member of the Pag-IBIG Fund, meaning you have made at least 24 monthly contributions |

| Age | You must be between 24 to 65 years old |

| Citizenship | You must be a Filipino citizen |

| Employment Status | You must be a permanent employee with a minimum of 6 months of continuous employment, or a self-employed individual who has been contributing to Pag-IBIG for at least 2 years |

| Financial Capacity | You must have the ability to pay the loan based on your income and other financial obligations |

| No Pag-IBIG Loan Default | You must not have any outstanding Pag-IBIG loans that are in default or foreclosure |

Meet the Membership Requirements

Before you can apply for a Pag-IBIG loan, you must first meet certain membership requirements. These requirements ensure that you are eligible and qualified to avail of the loan benefits.

Here are the membership requirements you need to fulfill:

| Membership Category | Requirements |

| Voluntary Membership | Must be at least 18 years oldMust have a stable source of incomeMust not have a pending Pag-IBIG housing loan |

| Mandatory Membership | Private sector employees and employersGovernment employeesSelf-employed individualsOverseas Filipino workers (OFWs)Informal sector workers |

| Employer Membership | Must be registered and active with the Philippine Business Registry (PBR)Must have a stable source of incomeMust have a valid Unified Multi-Purpose Identification (UMID) card |

Check if You Have Sufficient Contributions

Before applying for a Pag-IBIG loan, it is important to check if you have sufficient contributions to qualify for a loan. Pag-IBIG, or the Home Development Mutual Fund (HDMF), requires at least 24 monthly contributions to be eligible for a loan.

To check your contributions, you can visit the Pag-IBIG website and log in to your account. Once logged in, navigate to the “Membership Contributions” section. Here, you will find a table that shows your monthly contributions. Make sure that you have at least 24 contributions.

If you don’t have sufficient contributions yet, you will need to continue making monthly contributions until you reach the required number. You can do this by paying your contributions directly at a Pag-IBIG branch or through authorized payment centers.

Confirm Your Employment Status

If you are employed, you will need to provide your employment information such as your company name, address, and contact details. You may also need to submit proof of income such as pay slips or income tax returns.

On the other hand, if you are self-employed or a freelancer, you will need to provide your business details including your business name, address, and contact information. Additionally, you may need to submit your business permits or financial statements to support your income.

For overseas Filipino workers (OFWs), you will need to provide your employment contract or certificate of employment, as well as your latest payslips or remittance records.

Choose the Loan Program

When applying for a Pag-IBIG loan, it’s important to understand the different loan programs offered by the agency. Each program is designed to cater to different needs and requirements, so you can choose the one that best fits your situation.

Here are some of the loan programs offered by Pag-IBIG:

| Loan Program | Description |

| Multi-Purpose Loan (MPL) | This loan program provides financial assistance for various purposes, such as education, home improvement, health expenses, and more. It has a fixed interest rate and can be paid in up to 24 months. |

| Calamity Loan | This loan program is specifically designed to assist members who have been affected by natural or man-made disasters. It has a low-interest rate and can be paid in up to 24 months. |

| Home Construction Loan | For members who want to build their own house, this loan program provides financing for the construction of residential properties. It has a longer payment term of up to 30 years. |

| House and Lot Loan | If you’re planning to purchase a house and lot, this loan program can help you finance your dream home. It has a maximum loan term of up to 30 years. |

| Home Improvement Loan | For members who already own a house and want to renovate or make improvements, this loan program provides the necessary funds. It has a maximum loan term of up to 20 years. |

| Land Purchase Loan | If you’re planning to purchase a vacant lot for future use or investment, this loan program can help you finance the acquisition. It has a maximum loan term of up to 25 years. |

Gather the Required Documents

Before you can apply for a Pag-IBIG loan, you need to gather the necessary documents to support your application. Here is a list of the required documents:

- Loan Application Form – Fill out the loan application form completely and make sure to provide accurate and up-to-date information.

- Valid ID – Submit a photocopy of a valid identification card such as your passport, driver’s license, or any government-issued ID.

- Proof of Income – Provide supporting documents to verify your source of income, such as payslips, income tax return, or certificate of employment.

- Proof of Membership – Submit your Pag-IBIG Membership ID or any proof of your active membership with Pag-IBIG.

- Proof of Billing – Present a recent utility bill or any document that shows your current residential address.

- Collateral Documents (if applicable) – If you are applying for a loan that requires collateral, prepare the necessary documents such as a Transfer Certificate of Title (TCT) or a Tax Declaration.

Make sure to have multiple copies of these documents for submission. It is also advisable to keep the original copies for your reference.

Collect Income and Employment Documents

Before applying for a Pag-IBIG loan, it is important to collect all the necessary income and employment documents required by the organization. This will ensure that your loan application process goes smoothly and efficiently. Here are the documents you need to collect:

- Recent payslips – Gather your most recent payslips from your employer. The number of payslips required may vary depending on the type of loan you are applying for.

- Certificate of Employment and Compensation – Request a certificate of employment and compensation from your employer. This document should state your position, length of employment, and monthly salary.

- Income Tax Return (ITR) – Obtain a copy of your ITR from the Bureau of Internal Revenue (BIR) or from your employer if you are employed in the public sector.

- Bank Statements – Prepare your bank statements for the past six months. These statements will be used to verify your income and assess your financial stability.

- Proof of Other Income – If you have other sources of income, gather supporting documents such as rental contracts, dividend statements, or business income records.

- Valid IDs – Photocopy and present valid identification cards such as your passport, driver’s license, or social security ID.

By following this step-by-step guide, you’ll be well-prepared to apply for a Pag-IBIG loan and increase your chances of successful approval. Remember to gather all the necessary documents, attend the loan counseling session, and submit your application promptly. With the financial assistance from Pag-IBIG, you’ll be one step closer to achieving your goals and dreams.

What is a Pag-IBIG loan?

A Pag-IBIG loan is a type of loan offered by the Home Development Mutual Fund (HDMF), also known as Pag-IBIG Fund. It is a government agency in the Philippines that provides financial assistance to its members for the purpose of acquiring a home, financing home improvements, or availing of short-term loans.

What is the maximum loan amount that I can borrow from Pag-IBIG?

The maximum loan amount that you can borrow from Pag-IBIG depends on various factors, such as your monthly contribution, loan purpose, and capacity to pay. Generally, the maximum loan amount is PHP 6 million for home acquisition, PHP 2 million for home construction/renovation, and PHP 500,000 for multi-purpose loans. It is recommended to consult with a Pag-IBIG representative to determine the maximum loan amount you are eligible for.